Happy Vendors! Happy Business

Vendor Payments

Managing vendor payments can be complex, but with Finigenie’s Vendor Payment System, it doesn’t have to be. Our platform streamlines the entire process, ensuring timely and accurate payments to your suppliers.

Automated Vendor Payments

Never miss a due date again. Our system lets you schedule recurring payments, ensuring vendors are paid on time – every time – without manual intervention.

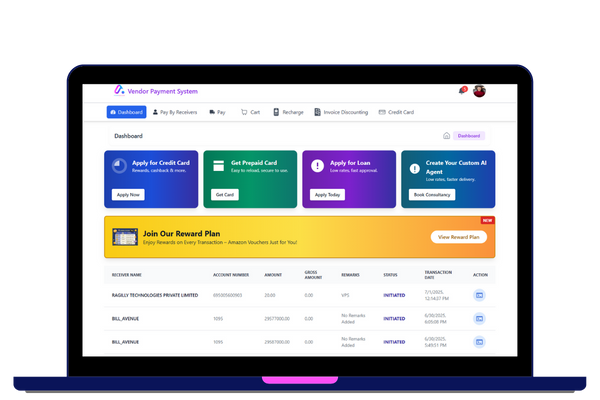

Real-Time Payment Dashboard

Track all your vendor payments in one place. With real-time updates, you gain full visibility into payment statuses, outstanding dues, and transaction history.

Easy Integration with Accounting Tools

Our Vendor Payment System integrates seamlessly with your existing accounting software, allowing for smooth data sync, accurate bookkeeping, and zero duplication of effort.

Multi-Currency Support

In today’s global marketplace, dealing with international vendors is common. Our Vendor Payment System supports multiple currencies, making cross-border transactions seamless and hassle-free.

Quick sign-up • Full access • 100% Free to register

Your Vendor Payments, On Autopilot — Try it Free

Tired of chasing vendor payments the old way? Let Finigenie handle the heavy lifting.

Set up smart, streamlined payouts — no spreadsheets, no stress.

01.

Vendor Onboarding & Data Integration

The Vendor Payment System starts by securely collecting and verifying vendor information. Seamless integration with your existing ERP or procurement software ensures that all essential vendor data – such as bank details and compliance documents – remain accurate and up-to-date.

02.

Digital Invoice Submission

Next, vendors can submit invoices electronically. These invoices are then automatically matched against corresponding purchase orders or contracts. If there are any mismatches, the system immediately flags them for review, significantly speeding up the verification process.

03.

Approval Workflow & Payment Processing

After successful validation, invoices enter a structured approval workflow. Authorized team members are notified to review and approve the payments with just a few clicks—keeping the process transparent and efficient.

04.

Reconciliation & Reporting

Finally, once approvals are in place, payments are processed electronically using secure methods like bank transfers or ACH. This ensures vendors are paid quickly, safely, and without delays.

How it helps

What are the benefits of our Vendor Payment System

Automated Payment Workflows

Streamline your entire payment cycle with automated workflows that reduce manual intervention and save time.

Real-Time Status Tracking

Monitor each payment in real time, so you’re always updated on what’s been processed, pending, or delayed.

Error Reduction

Minimize costly human errors with smart validation and system-led checks at every step.

Stronger Vendor Relationships

Make timely, transparent payments that boost your vendors’ trust and improve long-term partnerships.

Efficient Cash Flow Management

Gain better control over your outgoing payments, helping you plan budgets and optimize cash flow effectively.

Compliance & Audit Readiness

Maintain an accurate digital trail for every transaction, simplifying audits and ensuring regulatory compliance.

Seamless ERP Integration

Easily connect with your current ERP or accounting systems to keep everything in sync – no need for duplicate work.

Secure Transactions

Enjoy peace of mind with encrypted, secure payment gateways that keep your financial data protected.

Custom Approval Workflows

Configure multi-level approvals based on your business rules—giving you full control over who authorizes what.

We started using Finigenie to pay our raw material suppliers via credit card, and it completely transformed our cash flow. Earlier we were always chasing due dates—now we use the card cycle smartly and never miss a payment.

Finigenie made our vendor payments and bill settlements extremely easy. I can now pay multiple vendors in one go, schedule mobile recharges for staff, and even track every rupee spent. The dashboard is a game-changer.

We used to rely on manual logs and spreadsheets for payouts. Finigenie not only automated the entire process but also helped us qualify for a small business loan—all because our transactions were properly recorded.