Finigenie Business Payment Solutions

Pay Smarter. Track Better. Unlock Credit.

Manage all your business payments in one place—whether it’s paying vendors via credit card, transferring funds to bank accounts, handling mobile recharges or bulk utility bills. With Finigenie, you get complete control, real-time tracking, and the chance to build your creditworthiness through everyday transactions. It’s the smartest way to simplify vendor payments and grow your business.

What You Can Do

Pay Vendors via Credit Card

Use your card even if vendors don’t accept them. Funds go straight to bank accounts.

Credit Card to Credit Card

Make payments directly from your card to a supplier’s credit card.

Credit Card to Bank Account

Transfer funds from your credit card to a vendor’s bank account securely.

Pay Rents via Credit Card

Use your card even if vendors don’t accept them. Funds go straight to bank accounts.

Mobile Recharges

Do mobile recharges for various carriers directly from our platform. You can also recharge in bulk.

Bulk Bill Payments

Pay electricity, internet, and other bills for multiple vendors at once.

Cash Transfer Logs

Maintain clear records of every transaction with searchable logs.

Become Loan Eligible

Use your transaction history to qualify for business credit—no paperwork required.

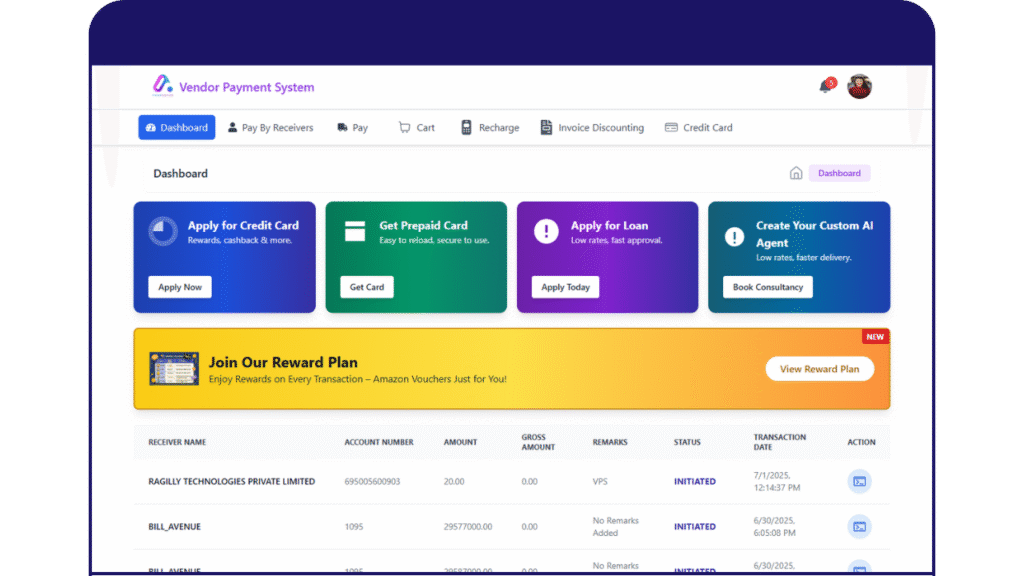

How It Works

Add your vendor

Easily add your vendors manually, upload via Excel, or integrate through APIs to manage all payees from one dashboard.

Select Payment Mode

Choose how you want to pay—credit card, UPI, bank transfer, or bulk bill payments—even if the vendor doesn’t accept cards.

Review & Approve

Set up approval workflows or handle payouts yourself with instant confirmation before every transaction is processed.

Track Everything

Use our real-time dashboard to monitor payment status, spending patterns, and vendor-specific transaction history.

Grow Your Credit

Every transaction is recorded and logged—helping you build a verified credit profile and become eligible for business loans.

Why Us

Why Switch to Finigenie?

Use Credit Everywhere

Make payments via credit card—even when your vendors don’t accept cards.

All Payments, One Platform

Handle vendor payouts, mobile recharges, and bulk utility bill payments in a single dashboard.

Turn Payments into Credit Power

Your transaction history helps build creditworthiness—no paperwork or collateral needed.

Full Control & Transparency

Set payment approvals, track every transaction in real time, and maintain complete control over your business spend.

Scenarios

How our Business Payment Solution work for your business growth

Scenario

Daily hotel bookings, vendor settlements, recharge needs, and payments to freelance guides created accounting chaos.

How We Helped

Finigenie offers a comprehensive Business Payment solution—enabling credit card payments to hotels, automated mobile recharges, and bulk partner payments—all from one dashboard.

Impact

Saved 15+ hours/month in admin work, improved vendor relationships, and unlocked access to short-term working capital.

Scenario

Multiple raw material suppliers, utility bills, and shift-based labor payments meant complex manual processes.

How We Helped

We centralized all payments—credit card to bank, bulk bills, and vendor disbursements—on a single smart platform with tracking.

Impact

Reduced payment errors by 70%, improved visibility on cash flow, and helped qualify for a credit line based on payment activity.

Scenario

High-volume payments for fuel, tolls, drivers, and vehicle maintenance vendors were difficult to monitor and reconcile.

How We Helped

Finigenie enabled card-based payouts, fuel card top-ups, and expense categorization for every transaction—fully traceable.

Impact

Cut operational leakages, gained full transaction logs, and improved cost control across fleet operations.

Scenario

Daily payouts to suppliers, marketing agencies, utilities, and staff created fragmented financial records and cash strain.

How We Helped

Using credit card-based payments and scheduled payouts, Finigenie helped manage bills, vendors, and recharges with ease.

Impact

Streamlined payments across stores, optimized credit card cycles, and improved financial reporting for better decision-making.

We started using Finigenie to pay our raw material suppliers via credit card, and it completely transformed our cash flow. Earlier we were always chasing due dates—now we use the card cycle smartly and never miss a payment.

Finigenie made our vendor payments and bill settlements extremely easy. I can now pay multiple vendors in one go, schedule mobile recharges for staff, and even track every rupee spent. The dashboard is a game-changer.

We used to rely on manual logs and spreadsheets for payouts. Finigenie not only automated the entire process but also helped us qualify for a small business loan—all because our transactions were properly recorded.